Yield generation by Making DeFi and TradFi working in synergy

DeFi and TradFi working in synergy

Earn yield through decentralized derivatives strategies Inspired by TradFi and adapted to DeFi

Our users are traders, dApps, DAOs, liquidity providers, stakers.

We offer them an easy to use platform to benefit from decentralized derivatives strategies proposed by experienced traders, and managed by sound risk practices.

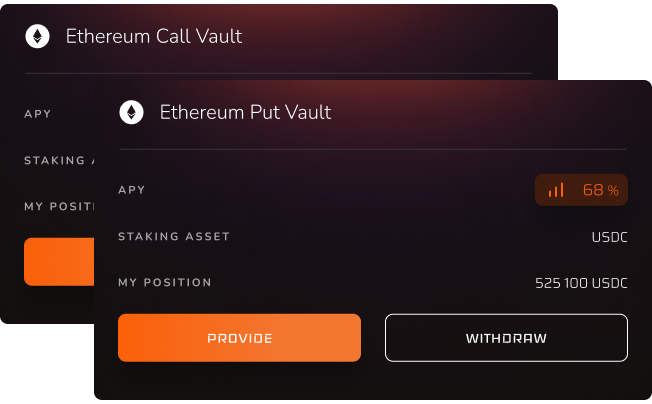

Dirac Finance dApp

Why Dirac Finance?

ADVANTAGES

ADVANTAGES

DeFi Depositors

Thanks to Dirac Finance, in just two clicks DeFi users can deposit in a wide range of vaults to generate returns via institutional-grade derivative strategies proposed by experienced traders.

TradFi Derivatives Traders

As a decentralized protocol, any derivatives trader can propose strategies to be incorporated in Dirac Finance vaults. Dirac Finance strategists come from companies such as HSBC, Goldman Sach and institutions such as Ecole Polytechnique, Imperial College.

Advanced Risk Mitigation

Beyond just security, Dirac Finance employs a suite of sophisticated risk mitigation techniques, including delta balancing, option hedges, and more, to protect investor principal.

Smart Algorithms

Dirac Decision Making Algorithm (DDMA) and Dirac Global Hedging Algorithm (DGHA) ensure optimal position initiation and comprehensive risk management.

Ecosystem

Team

Omar, CEO

+8 years exp in the banking industry

+4 years in crypto

Graduated from Ecole Polytechnique & Master's in Finance - France

Mo, CIO & CTO

+15 years in structured products

Expert in software development (Solidity, Python, C, C++)

PhD in Maths and Master's in Finance - HK, London

Nicolas, Lead Developer

In the crypto space since 2017

Smart contract security and gas optimisation expert

Blockchain Engineer graduated from ESILV - France

Kamal, Head of Treasury

International expertise in treasury management

DAO board member

BEM Graduate - Switzerland

Thomas, Senior Developer

Software engineer with 6+ years of experience

Contributing to the crypto market and Web 3 since 2017

University of Business and Technology - Hanoi, Vietnam

Salime, Developer

Blockchain Software Developer

Senior Web3.0 DApps Developer

Electrical and Telecommunication Engineer - Lomé, Togo

Daniela, Community Builder

Crypto investor

Defi, Web3 afficionado and content creator, Europe

Wenhao, Marketing Lead

Expertise in Digital Marketing and Growth Strategies

Experienced in Data & Business Analysis, and tokenomics

EM Lyon and East China Normal University - Paris, Shanghai